Madison Square Garden Entertainment (MSGE)·Q2 2026 Earnings Summary

MSG Entertainment Beats Revenue as Christmas Spectacular Sets 25-Year Record; Harry Styles 30-Night Residency Announced

February 3, 2026 · by Fintool AI Agent

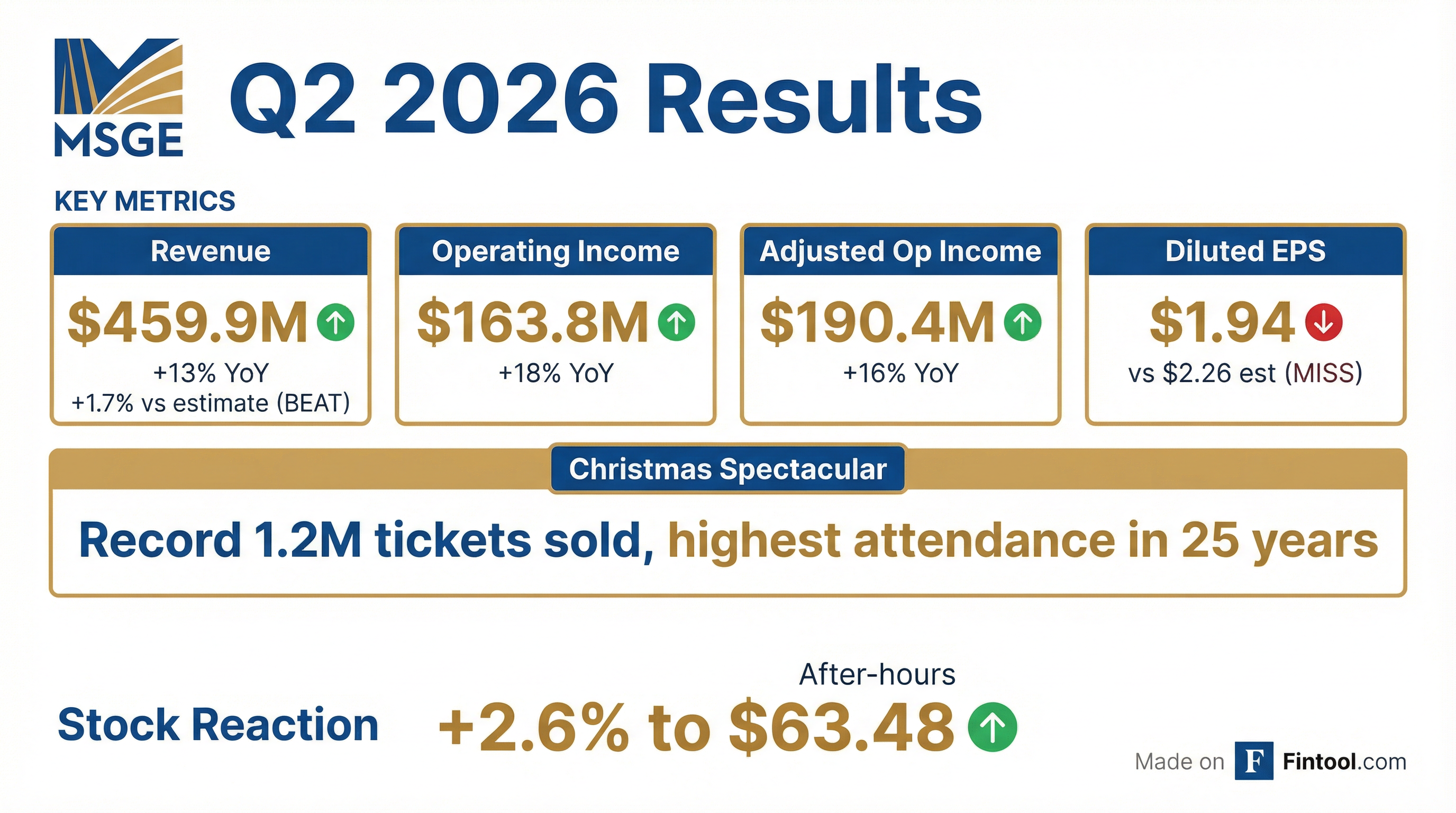

Madison Square Garden Entertainment (NYSE: MSGE) reported fiscal Q2 2026 results that topped revenue expectations but missed on earnings per share. The quarter was highlighted by a record-breaking Christmas Spectacular that generated approximately $195 million in total season revenue and sold over 1.2 million tickets—the highest attendance in 25 years. Looking ahead, management announced a 30-night Harry Styles residency at The Garden starting in August 2026, with 11.5 million presale registrations—the largest ever for a single artist in New York.

Did MSG Entertainment Beat Earnings?

Mixed quarter: Revenue beat, EPS miss.

Revenue of $459.9 million increased 13% year-over-year, driven by the Christmas Spectacular's record-setting run and higher arena event revenue. Operating income rose 18% YoY to $163.8 million, while adjusted operating income increased 16% to $190.4 million.

The EPS miss stemmed from a 20% increase in selling, general and administrative expenses ($68.4M vs $57.2M), which included $4.0 million in executive management transition costs.

What Changed From Last Quarter?

The fiscal Q2 (October-December) is seasonally MSGE's strongest quarter due to the Christmas Spectacular and NBA/NHL regular season start. Key changes from Q1 2026:

The dramatic sequential improvement reflects the seasonality of the Christmas Spectacular, which generates the bulk of its annual revenue in Q2.

Year-over-Year Performance (Q2 2026 vs Q2 2025):

Christmas Spectacular: Record-Breaking Season

The Christmas Spectacular Starring the Radio City Rockettes was the quarter's standout performer in its 90th holiday season:

- $195 million in total season revenue

- 1.2+ million tickets sold — highest attendance in 25 years

- 215 paid performances vs 200 shows last season (+7.5%) across 8.5 weeks

- Per-show revenue up mid-single-digit % driven by higher ticketing revenue and record F&B/merch per caps

- Growth in both individual and group ticket sales, with sell-through improvements

- Sphere Immersive Sound technology introduced at Radio City Music Hall, now in use for all concerts

International tourism headwind: Management noted the one exception to broad-based demand growth was international tourism, which was down versus last year—consistent with lower international tourism to New York during the holiday season.

Segment Performance Deep Dive

Entertainment Offerings: +13% YoY

Entertainment offerings revenue of $360.5 million increased $42.2 million, or 13%, driven by:

Arena License Fees: +18% YoY

Arena license fees and other leasing revenue of $35.2 million increased $5.3 million due to four more Knicks and Rangers games played at The Garden and higher other leasing revenues.

Food, Beverage & Merchandise: +8% YoY

F&B and merchandise revenue of $64.3 million increased $5.0 million:

- Knicks/Rangers game sales: +$3.3M (four more games + higher per-game revenue)

- Christmas Spectacular: +$2.7M (higher per-show revenue + 14 additional shows)

- Other events: +$2.3M (more events, higher per-event revenue)

- Concerts: ($3.3M) (fewer concerts at The Garden)

Q&A Highlights: Harry Styles Residency and FY2027 Momentum

The earnings call Q&A revealed several significant developments for fiscal 2027 and beyond:

Harry Styles 30-Night Residency

Management announced a record-breaking 30-night Harry Styles residency at The Garden:

- 30 concerts beginning late August through October 2026 (FY27 Q1/Q2)

- Every Wednesday, Friday, and Saturday for 10 straight weeks

- 11.5 million presale registrations — largest-ever presale for a single artist in New York market

- Structured as a rental deal (not co-promoted)

- While not all 30 nights expected to be incremental, management expects this to be a "meaningful contributor" to concert growth

"We are already seeing strong momentum in presales... Ticketmaster reported 11.5 million registrations, making this presale the largest-ever presale for a single artist in the New York market." — CFO David Collins

Concert Booking Momentum

Concert bookings at The Garden are showing exceptional strength:

- Exceeded full-year concert booking goal at The Garden already

- Pacing "well ahead" for FY2027 first half vs FY2026 first half

- Additional residencies: Bon Jovi 9-night run at The Garden this summer

- First-time Garden headliners: Olivia Dean, Alex Warren, Louis Tomlinson

- September 2025 quarter record for concerts at The Garden expected to be "shattered" in September 2026 quarter

"We are now on pace to shatter that record in the upcoming September quarter. We are encouraged by the early indicators for next year and believe that The Garden is likely headed towards another year of really strong concert growth in fiscal 2027."

New Sponsorship Deals

Marketing partnerships are gaining traction:

- Anheuser-Busch: Multiyear renewal

- Infosys: Expanded multiyear partnership including naming rights for the Theater at Madison Square Garden → now "Infosys Theater at Madison Square Garden"

Voluntary Exit Program

Management announced a cost restructuring initiative:

- Voluntary exit program implemented to "streamline processes and support a more efficient and nimble organization"

- ~$8 million severance expense expected, primarily in March quarter

- SG&A expected to normalize by June quarter

How Did the Stock React?

MSGE shares initially rose +2.6% in after-hours trading following the earnings release. As of market close on February 3, shares traded at $61.35, down 1.0% on the day after giving back early gains.

The stock reached an intraday high of $63.00, nearly touching its 52-week high of $63.10, before pulling back. Despite the EPS miss, shares remain up ~117% from the $28.29 trough, reflecting investor confidence in the Christmas Spectacular franchise and concert booking momentum.

What Did Management Guide?

CFO David Collins provided qualitative but not quantitative guidance:

"With a successful first half of the year behind us, we're confident that we are well on our way to delivering robust growth in revenue and adjusted operating income this fiscal year."

Key outlook points:

- On track for growth across both marketing partnerships and premium hospitality in FY2026

- Christmas Spectacular show count likely to increase again for next holiday season based on demand

- Concert sell-through rates for Q3/Q4 pacing ahead of same time last year

Consumer demand remains strong:

"We certainly keep a close eye on the macro environment, but I have to say, we continue to see strong consumer demand... A number of upcoming acts across our venues have added additional shows due to strong demand."

Beat/Miss History

Values retrieved from S&P Global

MSGE has consistently beat revenue estimates over the past five quarters but has shown mixed EPS results, reflecting the inherent operational volatility of the live entertainment business.

Balance Sheet Snapshot

As of December 31, 2025:

The company generated $184.2 million in operating cash flow in H1 FY2026 vs $85.5 million in the prior year period, reflecting the strong Q2 performance.

Key Risks and Considerations

-

Cost Pressures: SG&A expenses increased 20% YoY, including $4M executive transition costs and $2M one-time expense true-up. Voluntary exit program will add ~$8M severance in Q3

-

Seasonal Concentration: Q2 generates the majority of annual profits due to Christmas Spectacular; other quarters often report operating losses

-

International Tourism Decline: International ticket sales for Christmas Spectacular were down YoY, consistent with lower international tourism to New York

-

MSG Sports Relationship: Revenue sharing with MSG Sports for Knicks and Rangers games creates revenue volatility based on game schedules and team performance

-

Theater Bookings: While Garden concert bookings are strong, theater concert bookings continue to pace behind for March and June quarters

-

Penn Station Uncertainty: Potential redevelopment around Penn Station could impact the Theater at MSG, though management notes it is one of four theaters and has flexibility to shift events

Forward Catalysts

Near-term (FY2026):

- Q3 FY2026 earnings (expected May 2026): Will show post-holiday normalization and $8M severance impact

- Knicks/Rangers playoff potential: Additional high-revenue events if teams advance

- Penn Station decision (May 2026): Master developer selection still on track

- Tony Awards returning to Radio City in June

FY2027 and Beyond:

- Harry Styles 30-night residency (August–October 2026): Largest-ever single-artist presale in New York

- Bon Jovi 9-night run at The Garden this summer

- Rush multi-night run announced

- Potential theater residency in discussions for FY2027

- Record September quarter expected for concerts at The Garden

Long-term:

- Residency model becoming "important area" for booking business — building recurring base and forward visibility

- Christmas Spectacular show count expansion potential for next season based on demand

Data sources: Company 8-K filing dated February 3, 2026; Q2 2026 Earnings Call Transcript dated February 3, 2026; S&P Global Capital IQ estimates.